IL Form CO-2 2005 free printable template

Show details

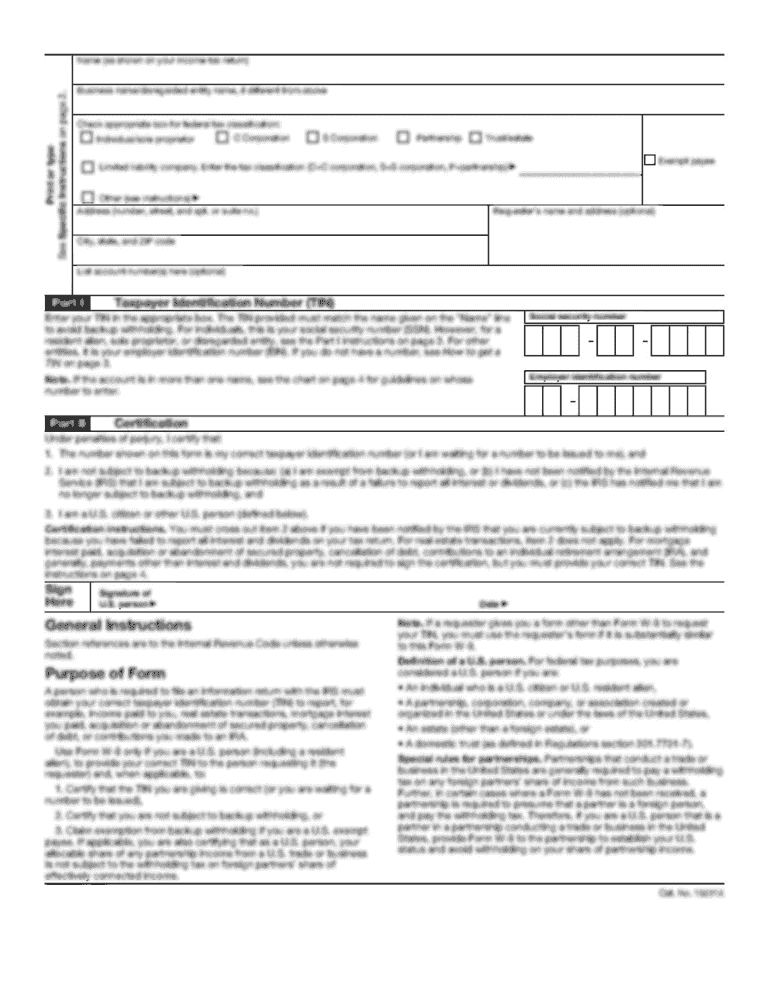

Organizations that have been in operation less than one 1 year are required to complete this form in compliance with the Charitable Organization Registration Statement Form CO-1 Line 20 and file each form with the Attorney General s Office Charitable Trust Bureau 100 West Randolph Street 11th Floor Chicago Illinois 60601. CHARITABLE ORGANIZATION Form CO-2 Revised 3/05 LISA MADIGAN ATTORNEY GENERAL FINANCIAL INFORMATION FORM PLEASE TYPE OR PRINT IN INK. Name address and telephone number of the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign illinois charitable trust bureau form

Edit your office of the attorney general charitable trust bureau form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois attorney general's charitable trust bureau form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing attorney general illinois charitable trust bureau online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit illinois attorney general charitable trust bureau form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL Form CO-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out il charitable trust bureau form

How to fill out Illinois attorney general charitable:

01

Obtain the necessary forms: Begin by acquiring the Illinois Attorney General Charitable Organizations Registration and Annual Report forms.

02

Provide organizational details: Fill out the forms with accurate and complete information about your charitable organization, including its name, mailing address, and contact information.

03

Describe the organization's purpose: Clearly state the mission and objectives of your charitable organization, explaining how it benefits the community and supports the public interest.

04

Provide financial information: Include details about the organization's financial operations, such as sources of income, expenditures, and assets. Attach any required financial statements or audit reports.

05

Disclose fundraising activities: Describe the fundraising methods used by your organization and disclose any professional fundraisers or commercial co-ventures involved in these activities.

06

Submit supporting documents: Attach any necessary supporting documents such as the organization's articles of incorporation, bylaws, and IRS determination letter.

07

Pay the registration fee: Include the appropriate registration fee with your submission. The fee amount may vary depending on the type and size of your organization.

08

Complete all required sections: Review all sections of the forms to ensure that you have answered all questions accurately and truthfully.

09

Sign and date the forms: Sign and date the forms to certify that the information provided is true and accurate to the best of your knowledge.

10

Submit the forms: Mail the completed forms, along with the required fee and supporting documents, to the Illinois Attorney General's office.

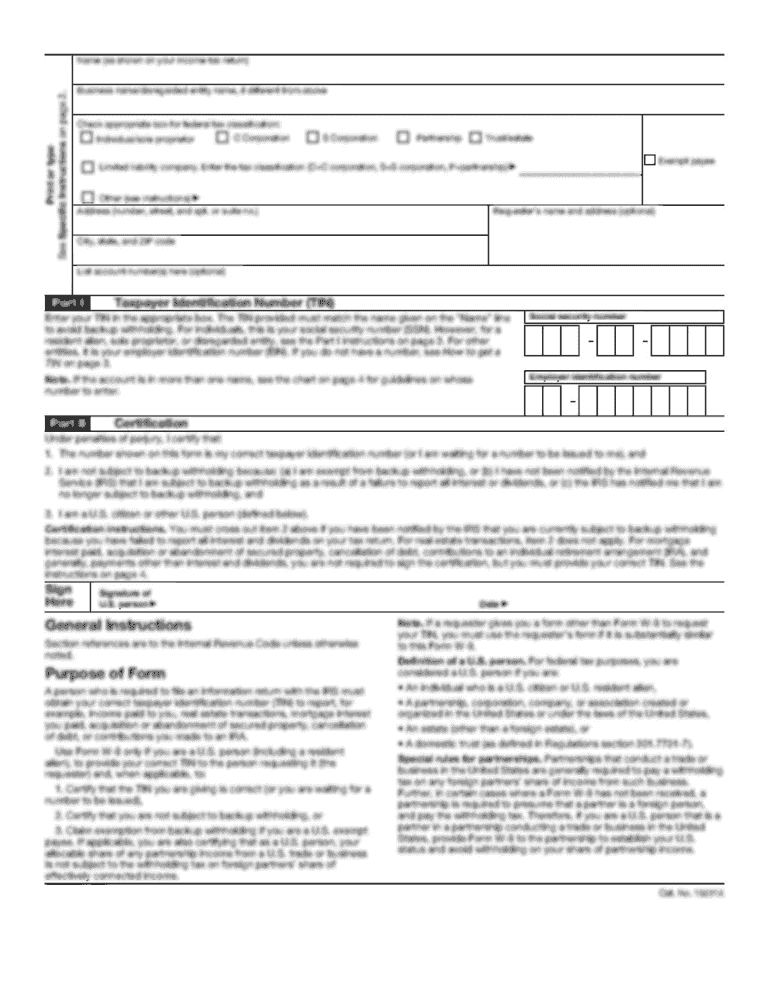

Who needs Illinois attorney general charitable:

01

Nonprofit organizations: Nonprofit organizations that operate for charitable purposes in Illinois may need to fill out the Illinois Attorney General Charitable Organizations Registration and Annual Report forms.

02

Charitable foundations: Foundations that provide grants or financial assistance to charitable causes in Illinois may also be required to complete the Illinois attorney general charitable forms.

03

Public benefit corporations: Public benefit corporations that serve the public interest and engage in charitable activities within the state of Illinois may need to comply with the Illinois attorney general charitable requirements.

Fill

form co 1 illinois

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute illinois attorney general charitable organization search online?

Easy online charitable trust bureau completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit form co 1 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing illinois charitable trust.

How do I fill out charitable trust bureau illinois on an Android device?

On Android, use the pdfFiller mobile app to finish your IL Form CO-2. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IL Form CO-2?

IL Form CO-2 is a form used by corporations in Illinois to report their corporate income and franchise tax obligations to the state.

Who is required to file IL Form CO-2?

Corporations doing business in Illinois or those who derive income from Illinois sources are required to file IL Form CO-2.

How to fill out IL Form CO-2?

To fill out IL Form CO-2, a corporation must complete sections detailing their income, deductions, and tax calculations, following the instructions provided by the Illinois Department of Revenue.

What is the purpose of IL Form CO-2?

The purpose of IL Form CO-2 is to determine the amount of corporate income tax owed by a corporation based on its income and deductions.

What information must be reported on IL Form CO-2?

IL Form CO-2 requires reporting information such as total income, allowable deductions, and the calculation of the tax due.

Fill out your IL Form CO-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL Form CO-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.